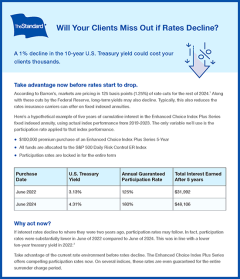

Will Your Clients Miss Out if Rates Decline?

A 1% decline in the 10-year U.S. Treasury yield could cost your clients thousands

Take advantage now before rates start to drop

According to Barron’s, markets are pricing in 125 basis points (1.25%) of rate cuts for the rest of 2024.1 Along with these cuts by the Federal Reserve, long-term yields may also decline. Typically, this also reduces the rates insurance carriers can offer on fixed indexed annuities.

Here’s a hypothetical example of five years of cumulative interest in the Enhanced Choice Index Plus Series fixed indexed annuity, using actual index performance from 2019-2023. The only variable we’ll use is the participation rate applied to that index performance.

- $100,000 premium purchase of an Enhanced Choice Index Plus Series 5-Year

- All funds are allocated to the S&P 500 Daily Risk Control ER Index

- Participation rates are locked in for the entire term

| Purchase Date | U.S. Treasury Yield | Annual Guaranteed Participation Rate | Total Interest Earned After 5 Years |

|---|---|---|---|

| June 2022 | 3.13% | 125% | $31,992 |

| June 2024 | 4.31% | 180% | $48,106 |

Why act now?

If interest rates decline to where they were two years ago, participation rates may follow. In fact, participation rates were substantially lower in June of 2022 compared to June of 2024. This was in line with a lower ten-year treasury yield in 2022.2

Take advantage of the current rate environment before rates decline. The Enhanced Choice Index Plus Series offers compelling participation rates now. On several indices, these rates are even guaranteed for the entire surrender charge period.

For example purposes only and are not intended to represent how your annuity may actually perform.

Data provided by Rafferty Annuity Framing LLC, 2024.

Sales Idea Flyer

Download this flyer to help foreign national clients.

More About Sales Insights & Tools

Related Products or Services

Doing business with The Standard is good for you and your clients. Our annuities offer innovative product design, desirable rates, competitive compensation, high industry ratings and excellent service.