Help Your Clients Protect Their Employees With Platinum Advantage GSI

Platinum Advantage GSI individual disability insurance can be a game-changer for employers offering long term disability insurance. Help them attract and maintain top talent in unique, highly compensated roles.

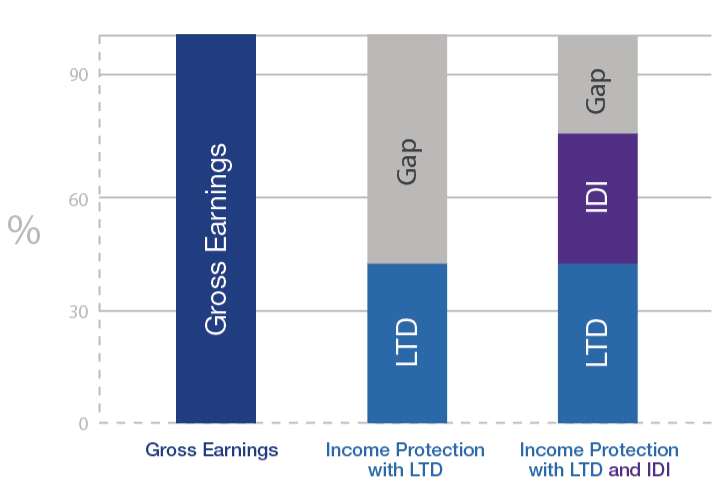

LTD insurance replaces up to 60% of an employee's base salary, but is often capped at a lower monthly amount. This usually results in a coverage gap for highly compensated employees.

By adding individual disability insurance to LTD insurance, you can offer comprehensive income protection for employees. This can help ensure adequate coverage if employees take time away from work due to disability leave. Another big plus is that this covers bonuses, distributions and other income incentives.

Key Features

- Family Care Benefit (Not available in California or New York)

- Regular Occupation Definition of Total Disability

- Guaranteed Renewable Policy

- Total Disability Benefit

- Presumptive Disability Benefit

How GSI IDI Can Help Reduce the Coverage Gap

This graph assumes an LTD plan of 40% income replacement to a $10,000 monthly plan maximum, coordinating with an IDI plan design of 75% replacement to a $10,000 monthly plan maximum, for a combined coverage maximum of $20,000 between plans.

This graph is intended for illustrative purposes only.

Family Care Benefit

Educate clients about coverage that provides a benefit if they need to take time away from work to care for a child, parent or spouse with a serious health condition.

Included With a Platinum Advantage GSI Policy

This benefit helps employees who have a loss of income due to taking time away from work to care for a child, parent or spouse with a serious health condition. This benefit is exclusive to The Standard.

It provides a monthly benefit if an employee works at least 20% fewer hours and has an income loss of 20% or greater. It can reduce the financial impact while caring for a family member.

Not available in California or New York.

Family members include an employee's spouse or domestic partner, parents and children (including adopted children, stepchildren and children of the employee's domestic partner).

The policy will be guaranteed renewable to age 65, or to age 67 for maximum benefit period “to age 67.” As long as premium is paid by the end of each grace period, we cannot change any part of the policy, except its premium, until the termination date.

This provision pays benefits if an employee cannot work in their regular occupation because of a total disability, as defined by the policy.

In Florida, during the first 12 months of disability, your client may be working in another occupation and still be considered totally disabled.

This benefit presumes the employee is eligible for the total disability benefit if an injury or sickness results in loss of speech, hearing in both ears, sight in both eyes or the use of both hands, use of both feet and use of one hand and one foot.

If the employee participates in a rehabilitation program to prepare for returning to full-time work, the rehabilitation benefit pays for the reasonable costs of the program.

The policy pays a survivor benefit equal to three times the policy's basic monthly benefit if the employee dies while disability or recovery benefits are payable.

This provision waives all premiums due under the policy while disability or recovery benefits are payable.

The policy pays a disability benefit if the employee becomes disabled as a result of transplanting a part of his or her body to someone else.

Optional Riders

This rider pays an additional monthly benefit if the employee suffers a catastrophic disability that prevents them from performing two or more normal daily activities without assistance, or they need supervision for their own health and safety due to severe cognitive impairment, as defined by the policy.

In California, a Catastrophic Disability Benefit will be paid only if the insured individual is presumptively disabled.

With this rider, the monthly disability benefit will increase by up to 3% or 6% annually based on changes in the consumer price index while the employee remains disabled.

With this rider, premiums and policy provisions will be locked in for the duration of the policy. We won't cancel the policy, raise premium rates or reduce coverage as long as the premiums are paid on time.

Noncancelable policy provisions are incorporated into the base policy in Florida.

These riders provide a benefit if the employee is residually disabled, rather than totally disabled, based on loss of income, duties and/or time.

Platinum Advantage GSI comes with three residual disability benefit options:

- Enhanced

- Basic

- Short-Term

In California, a residual disability rider is required.

This rider changes the policy's definition of total disability so that, instead of requiring the inability to work in any occupation after the first 24 months of disability, an employee will continue to be considered totally disabled if they can't perform the substantial and material duties of their regular occupation and they are not working in another occupation for wage or profit.

This rider changes the definition of total disability so that an employee may be eligible for benefits if disabled in their regular occupation but earning income from another occupation.

Endorsements

Benefits are paid for a pre-existing condition only if, on the date the employee becomes disabled, the policy has been continuously in force for 12 consecutive months and only if the pre-existing condition is not specifically excluded from coverage by amendment or endorsement.

This endorsement limits the period of benefit payments to 24 months for a disability due to a mental disorder and/or substance abuse.

The MDSA 24-Month Limitation Endorsement is required for all policies in California.