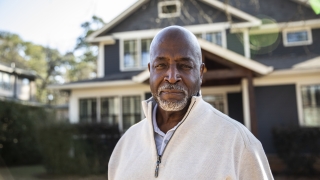

Life Stage: 51+

Saving for What's Next

As you move closer to retirement, it’s important to keep saving and make other financial preparations.

To help you focus, we’ve listed a few common obstacles faced by many people in your age group. You’ll also find some basic actions you can take to stay — or start — on the road to saving.

Challenges to Retirement Savings

- Retirement concerns. Many in the 51+ age group worry they won’t be able to retire when they want to.

- Multiple priorities. Saving is a key priority for members of this group, but paying off debt and covering living expenses can compete for dollars.

- Health issues. The goal might be to work past 65 or retire earlier. Either way, health problems can hamper retirement readiness. Illness may also lead people to retire sooner than planned.

- Social Security questions. People are living longer. Deciding when to take Social Security is an increasingly complex subject that may have a profound effect on your retirement.

- Financial strain. Some people in this age group find that money concerns are a major source of stress.

Over 80%

report saving for retirement in 2017 — with 31% saving more than last year.*

51%

consistently carry no credit card balances.*

55%

use an independent financial planner, broker or investment advisor.*

54%

plan to retire in the next five years.*

| Actions You Can Take | |

|---|---|

| Enroll in your employer’s retirement plan. | You may have faced obstacles in the past, but it’s never too late to start saving. You’ll find tools and calculators to help you set a savings target. Consider a double-digit contribution. The more you save now, the better your chances of reaching your goals. |

| Accelerate your savings. | Increase your retirement plan contributions as much as you can — even if it’s in incremental amounts every six months or annually. Now that you’re over age 50, you can take the opportunity to save even more with catchup contributions. Limits for these contributions are in addition to the regular annual contribution limits and vary each year. |

| Create or review your budget. | People who make a budget are more likely to achieve their goals. Write up an overview of your savings and expenses to help ensure your needs are taken care of, even if you’re also helping aging parents and grown children. |

| Review your financial strategy. | Know your estate planning options. Make sure beneficiaries, wills and trusts are up to date. Over 55? Consider revisiting plans for IRA gifting and estate taxes. |

| Make a retirement income plan. | Write out your sources of retirement income. Listing these sources makes it easier to develop an income plan for the entire length of your retirement. Include company retirement benefits, IRAs, your home value and your bank accounts. |

| Age 60 | |

|---|---|

| Target Savings Goal | 20% or more each paycheck |

| Aim to Save | 7x annual salary |

Am I On Track to Retire?

Now is a good time to check how close you are to meeting your retirement goal. You can log in to your account to see if you’re on track, or use this calculator for a quick estimate of how much more you might need to save.

Content Topics