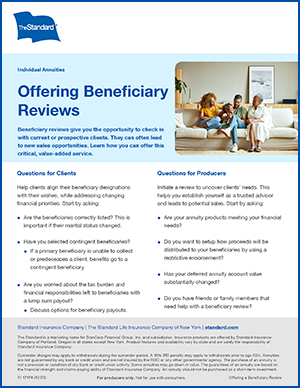

Offering Beneficiary Reviews

Beneficiary reviews give you the opportunity to check in with current or prospective clients. They can often lead to new sales opportunities. Learn how you can offer this critical, value-added service.

Questions for Clients

Help clients align their beneficiary designations with their wishes, while addressing changing financial priorities. Start by asking:

- Are the beneficiaries correctly listed? This is important if their marital status changed.

- Have you selected contingent beneficiaries?

- If a primary beneficiary is unable to collect or predeceases a client, benefits go to a contingent beneficiary.

- Are you worried about the tax burden and financial responsibilities left to beneficiaries with a lump sum payout?

- Discuss how they would like the proceeds at death structured.

- Discuss how they would like the proceeds at death structured.

Questions for Producers

Initiate a review to uncover clients’ needs. This helps you establish yourself as a trusted advisor and leads to potential sales. Start by asking:

- Are your annuity products meeting your financial needs?

- Do you want to setup how proceeds will be distributed to your beneficiaries by using a restrictive endorsement?

- Has your deferred annuity account value substantially changed?

- Do you have friends or family members that need help with a beneficiary review?

Client-Friendly Flyer

Download this flyer to lead your beneficiary reviews.

Content Topics

More About Sales Insights & Tools

Related Products or Services

Doing business with The Standard is good for you and your clients. Our annuities offer innovative product design, desirable rates, competitive compensation, high industry ratings and excellent service.